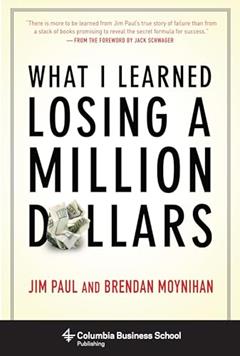

Summary of What I Learned Losing a Million Dollars by Jim Paul and Brendan Moynihan

Uncover the hard-hitting lessons from Jim Paul's financial journey in 'What I Learned Losing a Million Dollars'-a must-read for aspiring investors.

Sunday, September 28, 2025

If you ever thought losing a million dollars was a walk in the park, allow Jim Paul and Brendan Moynihan to shatter that illusion with their masterpiece, What I Learned Losing a Million Dollars. Spoiler alert: it's not a bed of roses. This book is like a financial slap in the face, wrapped in a cautionary tale of ego and the fool's gold of blind ambition.

Let's start with our dear protagonist, Jim Paul. He's not just your average Joe; he's a once-upon-a-time investment manager who thought he had it all figured out-until reality decided to teach him a hard lesson. The book kicks off by detailing his elaborate dance with financial reckless abandon. Picture a party where all your friends are showing off their perfect stock picks, and Jim thinks he's the king of the dance floor. Spoiler alert: he's not.

As we dive into the chaos of investment strategies and the perils of overconfidence-because who doesn't love a good overconfidence story?-we learn that Jim lost a whopping one million dollars. Yes, you read that right. One million dollars! As Jim tumbles from grace, the book reveals the not-so-pretty side of the investing world. From high-stakes trading to the dreaded margin calls-where your broker basically says, "Hey bud, pay up or lose it all"-we witness the rollercoaster of emotions that come with financial disaster.

But hold on, it's not all doom and gloom! Paul and Moynihan sprinkle in some valuable life lessons among the wreckage. They present a buffet of takeaways for anyone contemplating a career in finance (or looking to avoid its pitfalls). For instance, understanding your limits and the importance of emotional intelligence in investing is like discovering there's actually a good reason for having a safety net when you're jumping off a cliff. They also delve into the psychological aspects of money management, which is just a fancy way of saying: "Don't let your ego drive your investment decisions!" We all need that reminder sometimes, right?

The authors further dissect various psychological traps we fall into while dancing with our finances. From confirmation bias (where you ignore the bad news because it's not what you want to hear) to the sunk cost fallacy (ever stayed in a bad relationship because you've already invested so much?), they make it clear that these psychological pitfalls are lurking around every corner-just waiting to trip you up as you chase that next big score.

By the end of this enlightening page-turner, you'll not only sympathize with Jim Paul's plight but also gain insight into the lessons he learned in his financial "education." If you've ever felt like that million-dollar mistake is going to haunt you forever (or if you're currently checking your bank account with horror), this book is your cautionary tale, your guide to avoiding the financial depths of despair.

So put on your financial thinking cap and brace yourself for some ugly truths, because losing a million dollars may feel catastrophic, but gaining the wisdom from it? That's priceless.

Maddie Page

Classics, bestsellers, and guilty pleasures-none are safe from my sarcastic recaps. I turn heavy reads into lighthearted summaries you can actually enjoy. Warning: may cause random outbursts of laughter while pretending to study literature.